This article is from Big Technology, a newsletter by Alex Kantrowitz.

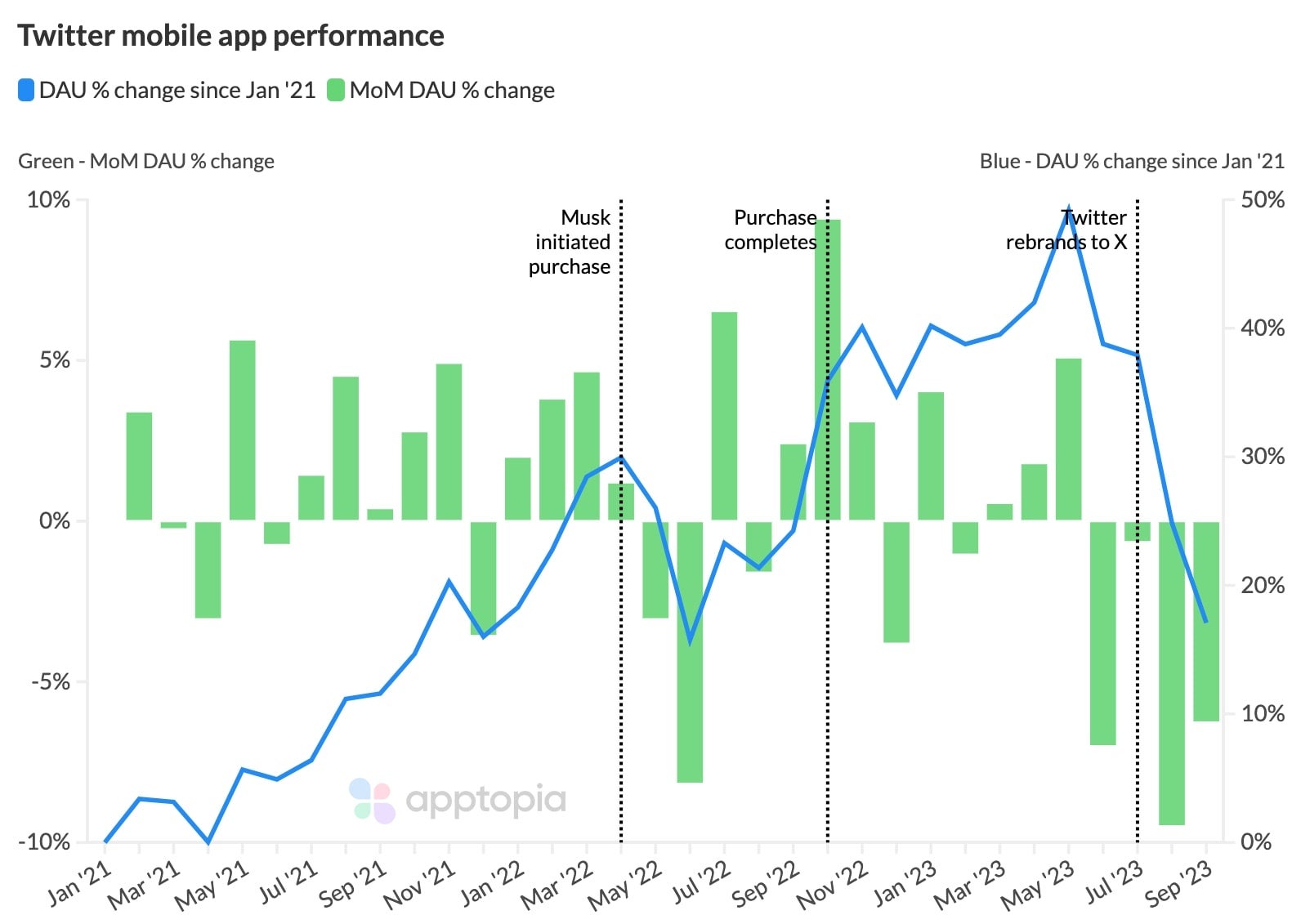

X is shrinking meaningfully under Elon Musk. Since Musk bought Twitter in October 2022, it’s lost approximately 13 percent of its app’s daily active users, according to new data from mobile research firm Apptopia (that I was first to report last week on Big Technology), and its rebrand as X only accelerated the decline. Meta’s Twitter clone Threads, meanwhile, isn’t taking advantage of its rival’s troubles, with stagnant engagement and little meaningful migration.

Apptopia pulls its data from more than 100,000 apps on iOS and Android, along with publicly available sources. Its new data should put to rest the countervailing narratives over Musk’s management of X. Under his stewardship, X’s daily user base has declined from an estimated 140 million app users to 121 million, Apptopia says, with a widening gap between people who check it daily versus monthly. X’s remaining daily users are engaged similarly as before. But the pool is shrinking.

Under Musk, X’s key use case has degraded considerably. The app built its relevance by delivering in-the-moment updates on key news events from firsthand sources and reporters. But Musk ditched this utility as he’s changed its main news feed algorithm; these days it privileges ChatGPT influencers, edgelords, and his business and culture-war confidants. Musk also overhauled verification into a paid feature, putting a larger burden on the user to sort through who might be close to a story and who might simply be LARPing as a source close to the news. It’s one reason the app is offering few reasons for many users to linger.

Beyond those UI changes, Musk’s July rebrand of Twitter to X—discarding a troubled but ubiquitous brand—caused the company serious harm. In both August and September, X lost more than 5 percent of its daily users month over month. This all but negated any positive momentum Musk generated during the takeover.

“After the sudden rebrand, there was a ~2,000% spike in negative daily app reviews,” Adam Blacker, Apptopia’s director of content and communications, told me. “The keywords ‘logo’ and ‘blue bird’ appeared as top 10 keywords left in user reviews, each with negative sentiments attached to them.”

The data contradicts X CEO Linda Yaccarino’s claim in July that X usage is at an all-time high, though Musk might’ve been correct with a similar statement about record user growth in November 2022. Those users didn’t stick around, however.

X’s remaining daily users are spending a consistent amount of time on the app, signaling it does have staying power among a dedicated core. The average user spends around 15 minutes on the app per day, per Apptopia. Asked to comment, X autoreplied, “busy now, please check back later.”

X’s usage continues to be top-heavy, according to the data. Power users—the top 10 percent—account for 72 percent of all time spent on the app, slightly more than the 70 percent they spent inside X in October 2022. This indicates that either a new group of power users replaced those who left or that power users and casual users left in consistent numbers.

Meta’s July launch of Threads was seen as a potential Twitter killer by some, but the data show it remains a dud. Threads has climbed the App Store lately, but after commanding more than 20 minutes of daily use from X users at launch, it’s fallen to below five minutes from that group today. Apptopia believes that only about 10 percent of X users have ever tried Threads. Mark Zuckerberg wants to get Threads to 1 billion users, but even returning to 100 million seems like a stretch.

Threads has shied away from news, discarding a surefire method to gain engagement. Its algorithm regularly surfaces posts from hours, or days, earlier, which means it’s not suited to fast-moving news events. Speeding the app up would likely improve engagement over time, but Meta is reluctant to jump back into news after its debacles in the 2010s. Life is simpler without it.

Musk is starting to charge some users $1 for X’s essential functions, which could open a new window for a competitor. But the decline of X usage without a replacement seems to confirm that the product—or something like it—simply does not appeal to the masses. With options like TikTok for entertainment and online publishers for news, being in the “room” as operatives and partisans yell at each other over breaking information isn’t the draw many imagined. One year after walking into Twitter HQ , Musk is learning this firsthand.